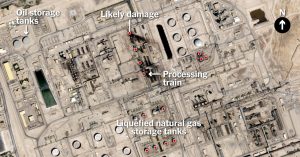

Wall Street sank into the red on Monday, after weekend buzz attacks knocked the oil out of Saudi Arabia’s production and the crude oil prices shooting higher and higher.

The lower open endangered to break an eight-day winning streak for the standard Dow Jones Industrial Average, with the major US stock falls just below fresh record highs.

The Markets were also taking a batch of worse economic data out of China and in anticipation of Wednesday’s Federal Reserve declaration on economic policy.

After the first ten minutes of the day’s trading, the Dow and broader S&P 500 were down to 0.4 percent at 27,112.32 and 2,996.52 respectively. The tech-giant Nasdaq was 0.5 percent lower at 8,139.64.

While the rise in oil prices WTI standard crude was upon climbing to a whopping USD 5.32 at USD 60.17 per barrel sent oil stocks higher, investors may panic more expensive oil could further slow a fading global economy.

Oil supergiants Exxon Mobil and Chevron were up 2.6 percent and 2.7 percent respectively.

spanking new economic data on Monday showed movement in China slowed last month diagonally the board, with the pace of industrial manufacture, retail sales and investment in fixed resources all lower.

In the USA, auto producers General Motors was fell to 2.9 percent after unionized workers began a countrywide strike over disagreements on wages or salaries, health care benefits and job security.

The Federal Reserve is extensively expected to declare an interest rate cut on Wednesday, the second of the year, as the US economy runs slow when compared to the rest of the world and US President Donald Trump‘s trade wars drag on.